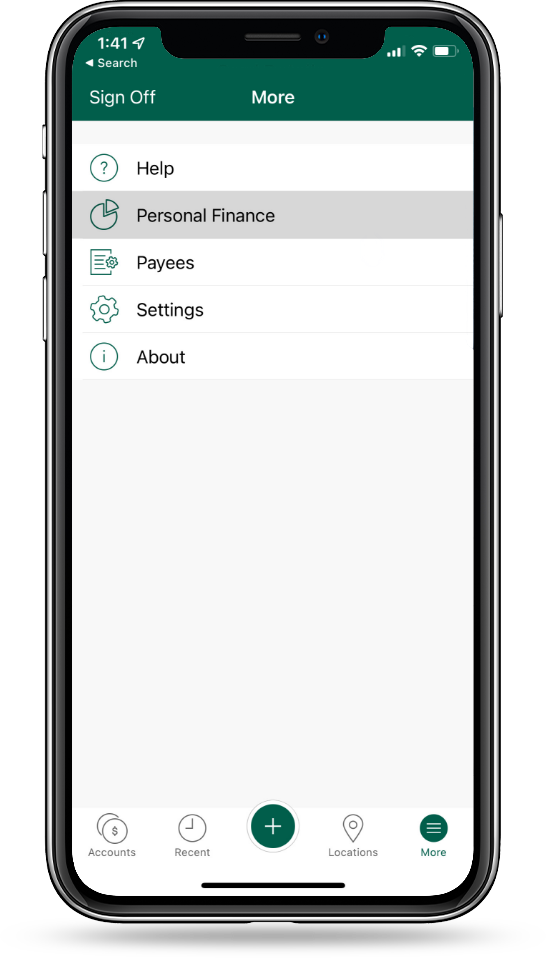

Your Personal Finance Solution

Control Your Money. Don’t Let it Control You.

Personal Finance is a digital money management tool, integrated into online and mobile banking, that empowers you to take control of your finances and simplify your life. Budgeting, account aggregation, categorization, and mobile access are just a few of the tools to guide you along your way. And it’s all available at no additional charge for Chambers Bank online banking customers.

All of Your Balances, In One Place

View your various financial account balances and transactions in one convenient place and get a complete picture of your finances. Our Personal Finance tool collects data from 10,000+ financial institutions to help you see your total financial health, not just the amounts you have in your checking or savings accounts. You can add loans, credit cards, investments, 401Ks and more… even if they’re not Chambers Bank accounts!

Identify Budget Areas That Need Attention

Visualize and interact with your budgets in a more meaningful way. Since not all budgets are created equal, using circles or “bubbles” to represent budgets allows you to quickly identify budgets that need the most attention. This feature also helps you set financial goals–such as growing your travel account or emergency fund–and helps you work toward meeting those goals.

Leverage Technology to Keep Your Accounts Safe

Your privacy and security are important to us, too. That’s why we encourage you to utilize the free tools we’ve made available to help keep your account information safe.

SecurLock Equip

With our SecurLOCK Equip app, you can receive a text alert every time your debit card is used, or limit the alerts to transactions over a specific dollar amount. Either way, you’ll know if someone else is using your card. And you can control your card from the app too, shutting down any fradulent activity immediately.

Online Banking

With Chambers Online Banking, you can customize alerts to easily monitor your account activity by text or email, including account balance, overdraft, deposits, check clearing and large dollar transactions.

eStatements

By enrolling in eStatements, you can reduce the risk of having your banking information in your mailbox or the trash can, where it could be stolen.