An upgraded digital banking experience is coming this fall!

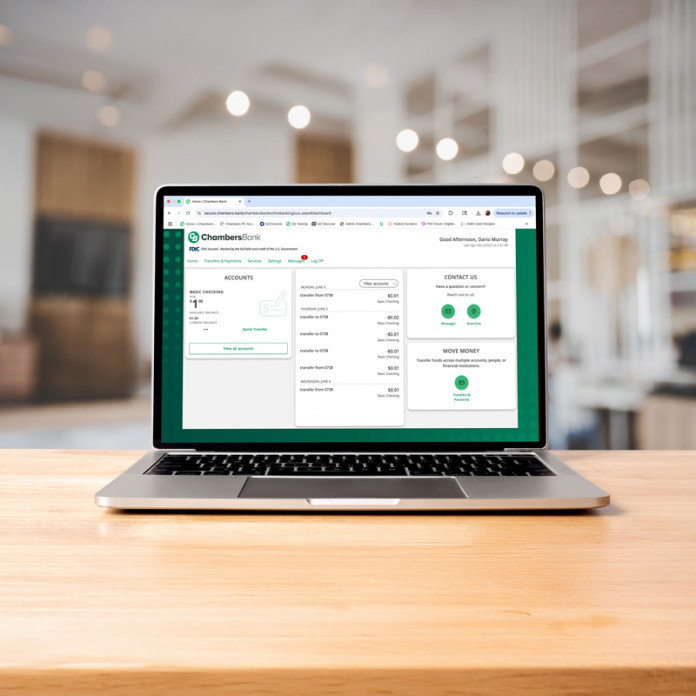

Chambers Bank is rolling out the "green" carpet for an exciting debut: our improved digital banking platform hits the screens on Monday, October 27! This isn’t just an update—it’s an elevated experience starring upgraded features, smarter design, and seamless access to the tools you use every day.

Coming Attractions:

A fresh new dashboard that lets you choose the way your accounts are listed!

Assign roles and permissions based on employee responsibilities.

Multi-factor authentication and soft/hard token support.

Track activity down to the user and action for full transparency and compliance.

Manage your Check and ACH Positive Pay decisions all in one place.

House and update the payment data for all your recipients in one place!

Cue the Q&A!

We’re setting the stage for smoother banking. Here’s what you need to know.

Yes.

- Make sure you have a recent version (last two released) of Google Chrome, Mozilla Firefox, or Apple Safari, or the latest version of Microsoft Edge.

- Prepare for a weekend outage. On Friday, October 24, Online Banking will be unavailable starting at 5pm (mobile app) and 7pm (desktop). The upgraded Digital Banking experience will be available on Monday morning, October 27.

- If you use Quicken or QuickBooks, please complete a data file backup and a final transaction download prior to 7pm on Friday, October 24. On Tuesday, October 28, you will need to deactivate your current business online banking connection within Quicken or QuickBooks, and reactivate your connection with the new Chambers Bank Digital Banking.

Step-by-step instructions are linked below: - ACH origination will be unavailable* beginning Thursday, October 23 at 4:00 PM. Please ensure all ACH payroll, payments, and collections are created and approved before this time. Access will resume in the new Digital Banking on Monday, October 27.

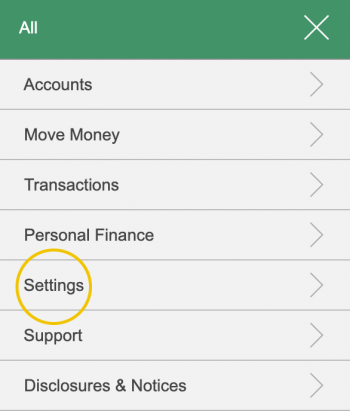

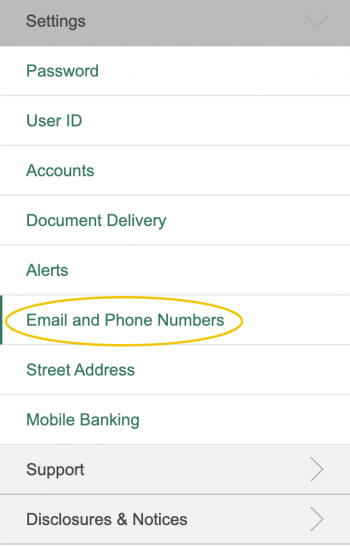

*ACH customers who have already converted to the new Digital Banking will be able to process with normal deadlines. - Please ensure your contact information is up to date in our system. You can update your contact information by logging in to your current Online Banking account from a desktop computer. After you've logged in, select All > Settings > Email and Phone Numbers. If you need assistance, contact us. We're always happy to help!

↓

↓

Yes! Our new Digital Banking platform is one seamless system, meaning no need for business customers to have a separate app. You’ll need to delete your current Chambers Bank Business Mobile app and download the new Chambers Digital Banking app after conversion.

You will log in using your current username and password—you will no longer enter a company ID. You will be asked whether you want to receive your Secure Access Code by text or phone call. Simply follow the on-screen prompts to enter your Secure Access code and finish logging in.

To avoid delays in accessing the new platform, please ensure your contact information is up to date in our system prior to October 27.

No. Once you have set up an initial access code, you will have the option to register your computer or device. Once your computer or device is registered, you will skip the secure access code requirement when you log in again.

Yes, at initial login, you will have access to 13 months of transaction history. Over time, the system will hold up to 24 months of transaction history.

You will continue to have access to 18 months of eStatements.

Yes. Any transactions (e.g. recurring transfers, bill payments) you have scheduled in our current online/mobile banking system will be carried over to the new platform and processed as normal.

Bill Pay will have an updated look with added features, but your existing setup will carry over automatically. Simply log in to Digital Banking, open the “Transfers & Payments” tab, and select “Bill Pay.” You’ll find all of your payees, scheduled payments, and templates ready to go—no extra steps needed.

Business customers can add or delete users, assign roles, and enable dual control for Wire and ACH origination to ensure secure transaction approvals. You may add as many users as needed to support your organization’s operations. Contact our team for assistance with setup or changes.

If your company is enabled for these services, you’ll be able to access wire and ACH templates, initiate transactions, and create tax payments (e.g., 941, 945). The wire cutoff time is 3:00pm daily, excluding weekends. The ACH cutoff time is 4:00 pm daily, excluding weekends. For tax payments, you'll select an effective date, and the system will confirm successful submission. Please note that same-day ACH is not supported for federal tax payments.

Yes. To ensure a smooth transition, please complete a data file backup and a final transaction download prior to 7:00pm on Friday, October 24.

On Tuesday, October 28, you need to deactivate your current business online banking connection within Quicken or QuickBooks, and reactivate your connection with the new Chambers Bank Digital Banking.

Step-by-step instructions are linked below:

Yes! We offer training sessions that cover online banking basics and in-depth instruction for advanced services like Wire and ACH origination.

Our crew is rolling out the green carpet to ensure a seamless experience. Stop by any branch for hands-on demonstrations and personalized assistance, or reach out to our Customer Care team:

1-800-603-1226 or (479) 495-2236

Monday–Thursday: 8:00am–5:00pm

Friday: 8:00am–5:30pm

Saturday: 9:00am–1:00pm

Se habla español.

Why the "Green" Carpet Treatment?

Because you deserve a digital experience that matches the care and convenience you get at every Chambers Bank location. We’ve taken your feedback, added a touch of magic, and created a banking experience that’s ready for its close-up.

Get Ready for Opening Day

Stay tuned for sneak peeks and helpful tutorials as we roll out everything you need to make the switch seamless on October 27. Until then, mark your calendar—because the future of digital banking at Chambers Bank is coming soon to a device near you.

Looking for information about the exciting upgrades coming to Personal Digital Banking?