If you’ve recently received a text, call, or email offering you a loan you never applied for, you’re not alone. Community banks across the country are seeing a sharp increase in fraudulent loan offers designed to trick people into sharing personal or financial information.

If you’ve recently received a text, call, or email offering you a loan you never applied for, you’re not alone. Community banks across the country are seeing a sharp increase in fraudulent loan offers designed to trick people into sharing personal or financial information.

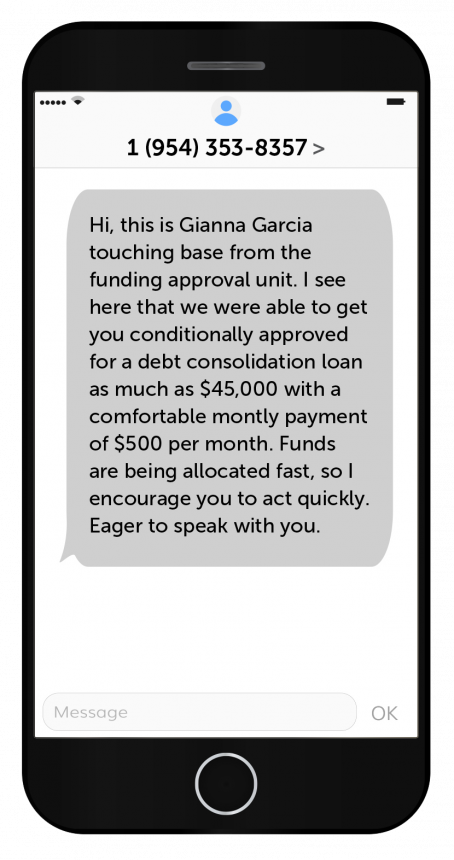

These messages often look legitimate—but they’re not.

How These Loan Scams Work

Scammers contact you claiming you’ve been pre-approved or selected for a loan. They may say:

- Your application is “already on file”

- You’ve been approved for a low-interest loan

- Immediate action is required to “secure your funds”

In many cases, the offer comes out of the blue, even though you never applied for a loan at all.

What Happens If You Respond

Replying—even just to say “no”—can put you at risk. Here’s why:

- You confirm your phone number or email is active, making you a target for more scams

- You may be asked to provide personal information such as your Social Security number, online banking credentials, or debit card details

- In some cases, scammers request upfront “processing fees” or direct you to move money

- If information is shared, it can lead to identity theft, account takeover, or financial loss

Legitimate banks will never pressure you to act immediately or ask for sensitive information through unsolicited texts or calls.

Red Flags to Watch For

Be cautious if a loan offer:

- Comes from an unfamiliar number or email address

- Creates urgency (“Offer expires today”)

- Asks for personal or account information

- Requests payment to “unlock” or “fund” the loan

- Uses vague language instead of specific loan details

When in doubt, pause—and don’t click, reply, or call back.

Why a Local Banker Makes the Difference

When you work with a local community bank, you always know who you’re dealing with. You can:

- Walk into a branch and speak with a real banker

- Call a local phone number you trust

- Ask questions without pressure

- Receive clear explanations of loan options that fit your needs

If you didn’t initiate the conversation, it’s not how your local bank does business.

The Safe Way to Explore Loan Options

If you’re considering a loan:

- Contact your local banker directly using a trusted phone number or branch visit

- Never respond to unsolicited loan offers

- If you receive a suspicious message claiming to be from your bank, contact us before taking any action

We’re always happy to help you verify whether something is legitimate.

When in Doubt—Ask Us First

Scammers rely on confusion and urgency. Your local bank relies on relationships, transparency, and trust.

If you receive a loan offer you didn’t apply for and something doesn’t feel right, trust your instincts—and reach out to your banker. We’re here to help keep your finances safe.