Monitoring your checking and savings accounts regularly leads to improved financial wellness and lower financial risk.

Your primary bank accounts are some of the most important tools you will ever own. From paying bills and receiving income to saving cash and moving money into investments, your checking and savings accounts are the hubs of your everyday activities and channels for your long-term financial goals.

How often should you be monitoring yours?

The answer will vary for everyone, but the more frequently you use your accounts, the more often you’ll probably want to review them. To give you a little perspective, a benchmark study by Lexington Law found that 36% of Americans monitored their checking accounts every day while 30% monitored theirs once per week; the remainder checked their accounts two times per month or less.

As you read along, this blog will give some strategies for overseeing your accounts, including:

- Things to consider when monitoring your accounts.

- The benefits of regularly reviewing your checking and savings accounts.

- Free Chambers Bank tools for viewing your accounts and keeping them secure.

Monitoring Your Checking Account

If you earn money and have living expenses, a checking account is likely the main account you use to receive earnings and pay your bills and debts. That said, with frequency of transactions coming and going, choosing to review it at least several times a week is reasonable.

What about looking at the account each day? Being on a tight budget or keeping a low balance are a few reasons people check accounts more often, as are watching for checks to clear and just having reassurance that finances are safe.

No matter how much you review your checking account, remember to take time each month to balance your account statement against your transactions so you know the balance is accurate and that no unauthorized transactions have occurred.

Monitoring Your Savings Account

Many banks and credit unions today will have you open a savings account that coincides with your primary checking account, which serves a few good purposes. For one, the savings account can back up your checking account if there isn’t enough cash available to cover an expense. Additionally, the savings account can be a place to store cash until bills are due. Keep in mind, however, that if you make more than the minimum allowed withdrawals per month from your savings account, you will generally incur extra charges.

So how often should you check your savings account?

If you seldom withdraw cash from your savings account, you probably don’t need to look at it more than once per month. But if you make multiple withdrawals per month, review it when you review your checking account and also match it against your bank statement each month to note all deposits, withdrawals, and interest accruals.

Benefits of Monitoring Your Bank Accounts

Taking time to review your bank accounts regularly comes with a host of benefits, and here are some top reasons you might want to make it a habit:

Watch for Fraudulent Activity

The Federal Trade Commission (FTC) reported that bank fraud cases grew 39% in 2021 compared to the previous year, with rises in fraud related to debit cards, electronic funds transfers, ACHs, new accounts, and existing accounts. Even more surprising, there was an 84% rise in check fraud from 2021 to 2022 according to the Financial Crimes Enforcement Network.

While these statistics may seem frightening, monitoring your accounts, using strong online passwords, and keeping your paper documents private are some one of the best ways to assure your funds and personal information remain safe. And remember … the earlier you detect an issue, the faster it can be resolved.

In this respect, please contact Chambers Bank right away if you notice any activities like this on your accounts:

- Unauthorized charges from unknown entities

- An unrecognized deposit or withdrawal

- Checks posting out of order

- A string of overdraft fees

- Warnings that your account has been frozen

Reminder: If you find unauthorized charges against your account resulting from theft or loss of your debit card or theft of your account information, it’s important to act quickly to avoid paying for the transactions out of your own pocket. By notifying your bank within two business days of incurring the unauthorized charges, you will only be responsible for up to $50. After two business days and before 60 days, that amount changes to $500. If you wait more than 60 days to report unauthorized charges, you could be responsible for paying the full amount.

Prevent Unnecessary Bank Fees and Charges

Watching your accounts regularly not only helps you make sure you’ve got enough funds to cover withdrawals, but it also assists you in avoiding unnecessary fees and charges.

With this in mind, take note that many Chambers Bank personal and business accounts require you to maintain a minimum balance in order to avoid monthly fees and maintain the Annual Percentage Yield (APY) on your account’s interest earnings.

Additionally, if your account balance doesn’t cover charges made against it, you may incur overdraft fees and stop payment fees on each transaction attempt. To avoid this problem, you can:

- Sign up for overdraft protection.

- Maintain a Chambers Savings Account and set it up to transfer cash to your Chambers Checking Account if there aren’t enough funds to cover charges.

- Set up Account Alerts to let you know when your balance falls below the minimum amount you indicate on the alert.

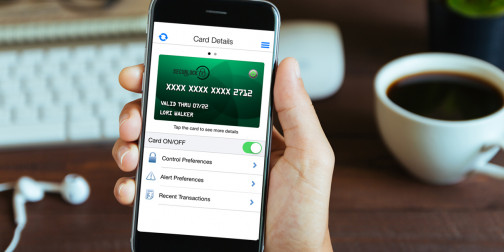

- Get the SecureLOCK Equip app to give you additional control over your Chambers Bank debit card.

Manage Your Finances Better

Are you saving for something big like a car, a vacation, or an education? If so, keeping tabs on your bank accounts can help you reach your savings goals faster since you can see the balances go up every time you save money.

The other great thing about watching your accounts is that it can help you budget more accurately. Let’s say you have an unexpected expense arise such as a doctor’s bill or a home repair. By knowing what’s in your account, you can determine if you have the money to cover the bill or if you need to use emergency funds or borrow cash to make the payment.

Overall, with inflation and interest rates higher than they’ve been in years, managing a budget is more important than ever and watching your account expenditures regularly is one of the best ways to safeguard against overspending.

If you don't already use Chambers Personal Finance tool, now is the time to get started.

How to Monitor Your Chambers Bank Accounts

At Chambers Bank, the safety and security of your bank accounts is one of our top priorities and that’s why we provide everyday tools to help you manage your finances anytime and from anywhere.

You can gain access to all of our best tools by first enrolling in Chambers Online Banking. Once you sign up, you’ll be able to view your accounts from any computer with internet access and then sign up for the following (and more):

Mobile Banking. When you download the Chambers Bank App on your smartphone or tablet, you can set up Mobile Banking for your personal and business accounts plus gain anytime, anywhere access to all accounts. Make deposits, run transfers, and complete online payments in just a few clicks.

Account Alerts. This great feature of Online Banking allows you to set alerts for a variety of transactions and have alerts texted to you, emailed to you, or both.

eStatements. Enrolling in eStatements is not only a quick and easy way to access your account statements, but it also allows you to safely store documents online and cut down on paper waste. Sign up in just five easy steps.

Getting the Most Out of Your Chambers Bank Accounts

After reading this article, we hope you’ll be able to use our Chambers Bank tools to monitor and manage your bank accounts. For additional information about keeping your accounts private and secure, please see our page Protecting Yourself & Your Finances. Finally, if you have any questions about our banking tools or managing your accounts, contact us anytime during business hours at 1-800-603-1226 or submit an online inquiry.